Challenge: Develop Risk-Based Asset Renewal Programs

The South Coast British Columbia Transportation Authority (“TransLink”) is Metro Vancouver’s regional transportation authority. Under its Capital-M program, TransLink is modernizing systems and processes supporting asset lifecycle management, risk assessment, and investment planning. TransLink required the development of optimal risk-based long-range capital programs for a range of asset classes including asphalt and concrete pavement, facilities, stations, escalators, elevators, hoists, revenue and non-revenue vehicles, among others. Translink required a unique solution that can support data-driven asset lifecycle modeling, instead of a simplistic age-based approach. The solution also needed to support detailed analysis of the relationship between funding levels and performance and risk measures of the asset portfolio, and the ability to optimize project selections to ensure that scare funding resources are invested on the right project at the right time.

“The Asset Renewal Programs are meant to be long‐term, forward‐looking capital programs to justify the asset reinvestment required to maintain a state of good repair for our assets. The process for developing these programs was based on readily available data and information to support the identification of the optimal lifecycle for the assets and the development of a capital investment program for on‐going capital planning. IDS brought insightful data analysis and recommendations with their asset lifecycle modelling techniques and reliability metrics, specifically with regards to the pavement asset class. The IDS team displayed an innate ability to communicate the technical aspects of the assets, based on their understanding of the asset needs and challenges while also being able to bring a big picture perspective on asset management implications. The IDS team clearly established and identified the deliverables for our project, including being very clear and transparent about maintaining the project on time and on budget. At TransLink we have greatly valued the advice and direction from IDS to be well‐informed and supportive of our Asset Renewal Programs.”

– Llewellyn Fonseca, TransLink

Solution: Asset Optimizer

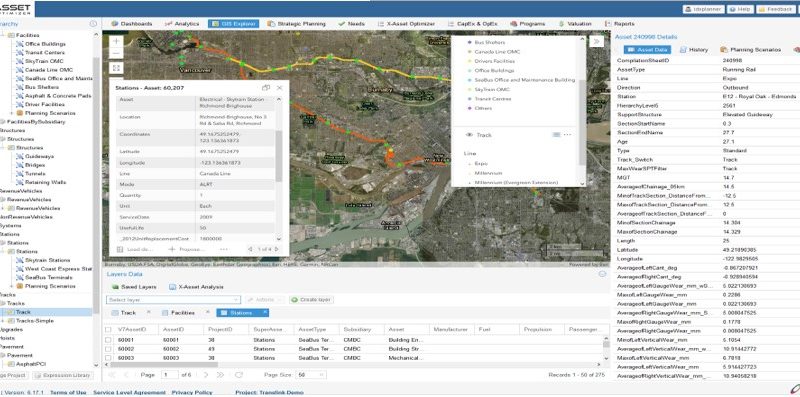

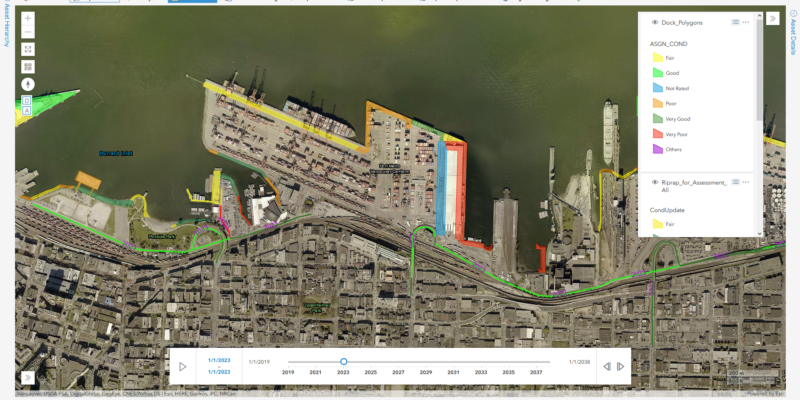

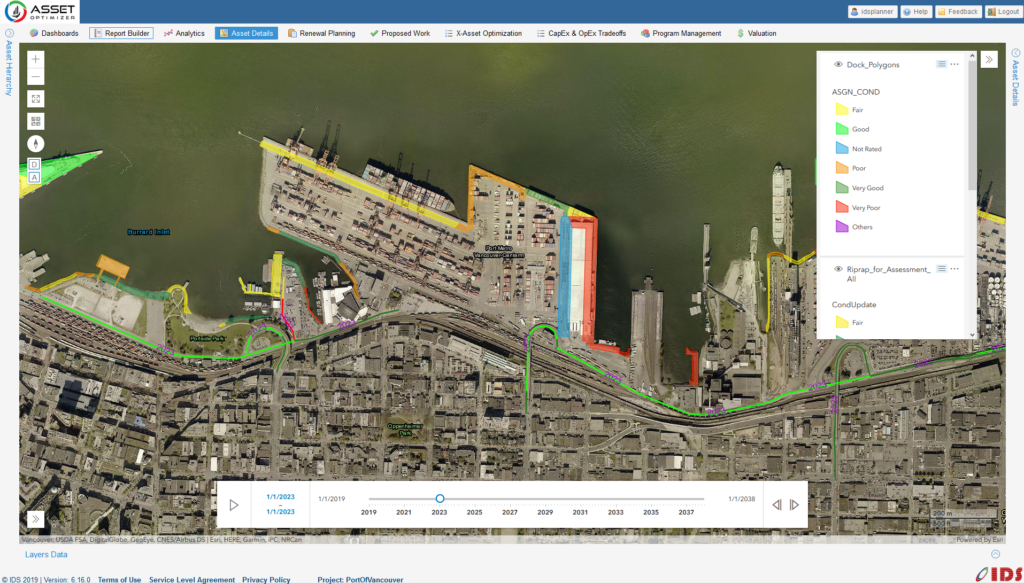

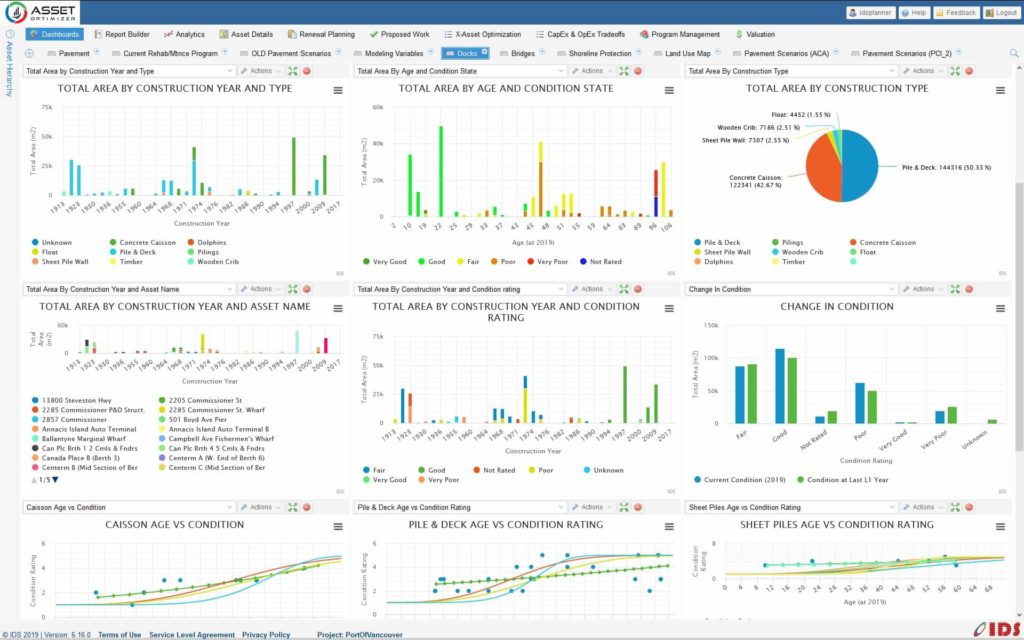

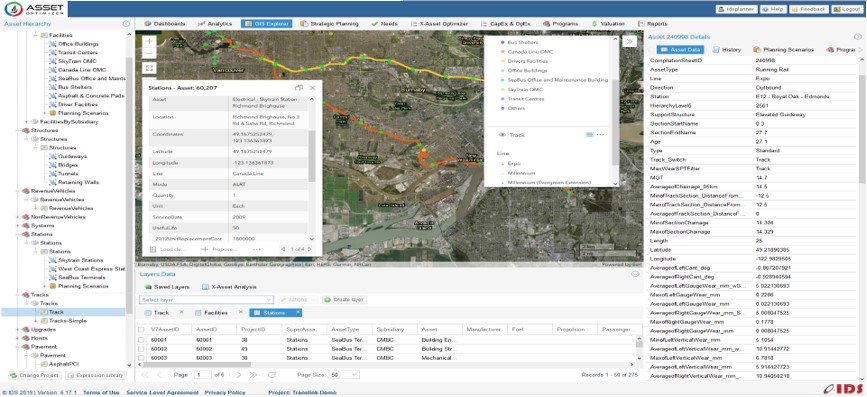

In collaboration between AECOM Canada Ltd and IDS, Asset OptimizerTM GIS-centered cloud-based software was used to support the development of deterioration models and optimized risk-based capital programs for several TransLink asset classes. Assets data were directly imported from ArcGIS and Excel, and organized in a multi-level hierarchy. Asset OptimizerTM was then used to perform in-depth data analysis and develop data-driven deterioration and risk models for each of the asset classes. Costs and benefits models for various asset intervention actions (e.g., repair, rehabilitation, and replacement) were also developed, along with constraints governing these interventions.

Multiple budget and performance target scenarios were defined and used to generate optimal annual project lists that maximize assets performance, minimize the risk, and minimize lifecycle costs. The scenario results helped to accurately determine funding needs to meet target system-level performance or risk levels, and also to assess the impact of various investment levels on the system performance and risk metrics. This analysis made it possible to quantify the relationship between funding levels and assets condition and risk metrics, and to develop optimized and defensible 20-year asset management plans.